Summary

Fox News host Julie Banderas warned that President-elect Donald Trump’s proposed tariffs—25% on products from Mexico and Canada and 10% on those from China—could significantly raise costs for Americans, as many businesses rely on foreign goods.

While some companies are shifting to U.S.-based suppliers or stockpiling goods ahead of the tariffs, Banderas noted that buying American often results in higher prices.

She highlighted that the financial burden would likely fall on consumers, questioning, “Who’s going to pay for that? We are.”

Economists have also warned of inflation risks.

Man, I sure am worried about deflation.

Deflation is actually really bad. It essentially means that not spending money is the best option, which makes it so people stop buying as many things and the economy slows down dramatically. A small amount of inflation is ideal. It encourages spending but doesn’t do much harm either.

This sounds completely backwards, like if you are talking purely about investment.

If not it seems to completely ignore that high prices alone would discourage spending, particularly on non-essential things (even then, don’t think for a second that there aren’t people skipping healthcare or meals).

The only other way I could interpret would be that high prices force people to spend more money on just essentials (even if they’re buying less than they otherwise would), somehow painting living paycheck-to-paycheck as a good thing because it means more money in the economy.

It’s not about the price. Price is just a number. Prices today would look insane to someone 100 years ago. It’s about how price changes over time.

If your money becomes less valuable the longer you wait, it’s worse to wait. The longer it takes for you to spend it the less buying power it has.

If it becomes more valuable over time then it encourages hoarding your money because the longer you take to spend it the more buying power it has.

The average person likes stuff and wants their stuff now. The average person will buy shit on a credit card even though saving up to pay cash would make the cost much cheaper. Particularly disciplined people may put off purchases for a few months if they think the price will drop (maybe a few years for something really big like a house) but those folks are the exception rather than the rule. Are there real world examples of times when deflation triggered a mass consumer cash hoarding? Or is this something that only exists in economics books?

If you’re talking about investing and the behavior of companies, then maybe you’re right. Although I suspect it would also depend on interest rates and stock market performance.

The average person buys their stuff from companies and investors or businesses who get their supplies from said companies and investors. The people will not be able to buy things if those companies decide that they are more profitable sitting on pile of coins.

That’s actually neoliberal propaganda and not true. “The economy” in the context of GDP turned out to really mean “rich people”.

In our current economic model, any deflation creates a perverse incentive to not spend. It is extremely bad for the economy, and all of us reliant on it. The rich are one of the few groups that come out ahead (relatively).

Like it or not, we are all stuck on that merry go round. Until we find a graceful way off, it’s in no-one’s interest to jam it up.

Our current economic model is a humanitarian and ecological disaster. We need to pump the brakes. Many more lives will be lost due to excessive consumption and inequality - we’re out of time for graceful.

There’s a difference between pumping the brakes and throwing a grenade into the fuel tank. A large scale economic collapse would be devastating. The world economy is so interdependent now that even minor disruptions cause problems.

I’m all for pumping the brakes, but we either need to stop gracefully, or have an alternative to jump to.

No, we absolutely do not. It’s too late to stop gracefully - I cannot overstate how much worse it’s going to get if we stop even now.

Consumption needs to go down, this will collapse the delicate house of cards we’ve built… and we have no other choice.

Après moi, le déluge

So how do you see deflation going then? Particularly deflation of the defacto reference currency for most of the world?

As far as I can tell, it would make the disruption of covid look like a minor market blip. And that’s without looking into how the various chain reactions would play off and amplify each other on the global stage.

Can you not eat? There are some things you have to consume all days.

Just basic requirements for life and nothing extra will destroy any developed countries economy. If things aren’t sold they’ll stop sending them there, so as people just stop buying luxuries, they’ll stop even being an option. Less tax money means the government has issues more than normal, and if you aren’t buying anything who are they gonna tax? The companies won’t have money because they aren’t selling anything.

If you don’t buy luxuries but keep buying groceries, what do you think they will do? Just a hint: groceries also have taxes.

so they lose a significant amount of tax revenue and you say its fine because they didnt lose all of the tax revenue? Or are you suggesting they crank the tax on groceries up like nuts and just let the people die when they can’t afford to eat?

The second one.

Sure, yeah. It’s especially sucks for rich people and business owners, but no it’s not just “neoliberal propaganda.” It’s really simple economics and logic. If your money becomes more valuable over time, it is on your benefit to save it. If it becomes less valuable over time, the opposite is true and you should spend it. And yeah, capitalism sucks, but we’re all tied to the health of the economy, which doesn’t mean the stock market like the media often links it to, but if businesses can’t afford to hire as much staff, all of us lose.

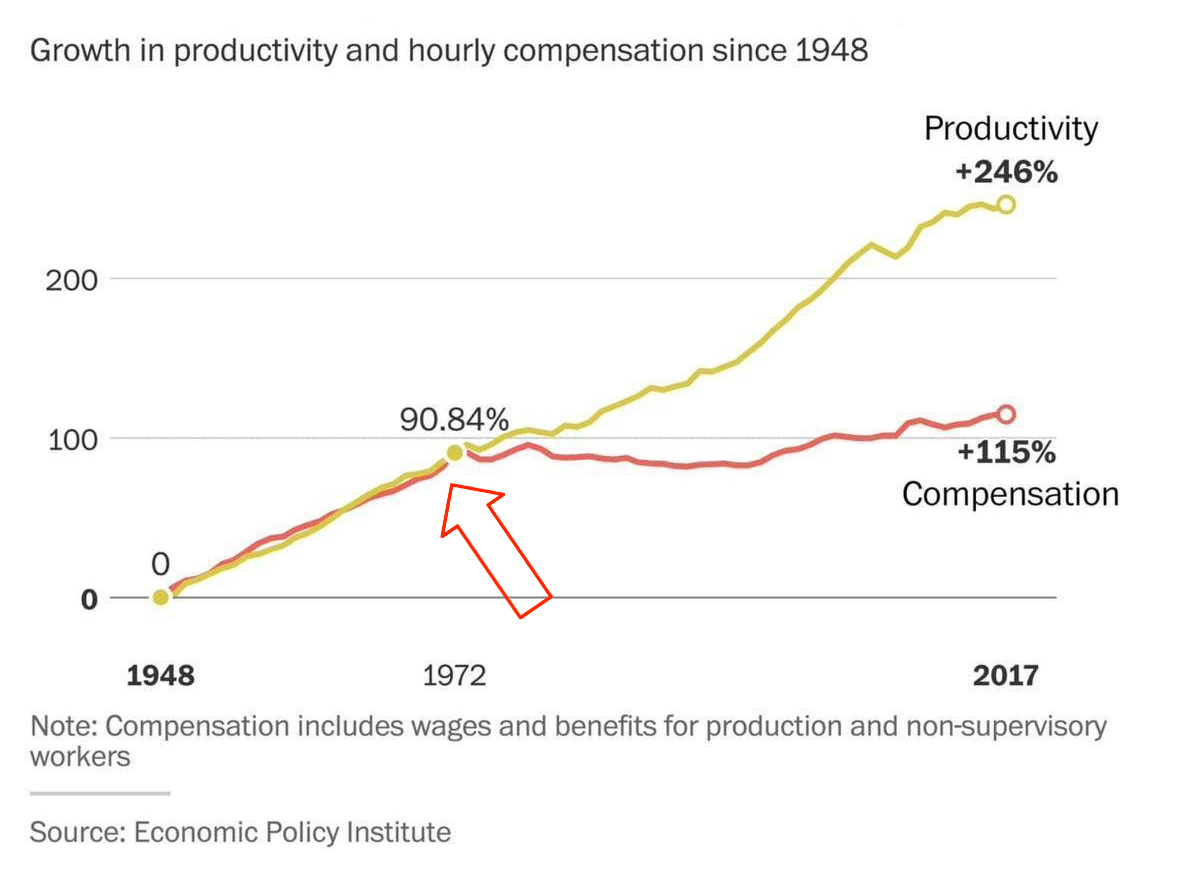

This is true, but it’s a bad thing. The economy would be better off if people had savings. We could afford to strike without going homeless. We would consume less and pollute less. Wages would be growing in proportion to the overall economy, not falling relative to the cost of living.

Us being forced to spend money on businesses is good for the businesses, but it hasn’t been good for us. Businesses being able to hire more people because we’re forced to invest in them is trickle-down economics.

Wages would not necessarily grow in proportion to the economy. In fact, they probably wouldn’t. It’s a nice idea, but it’s assuming a lot. As more people are laid off, there’d be more people competing for the same jobs, allowing businesses to pay less. They’d also be in the same situation as everyone else, where spending is disincentivized. I don’t know about you, but I’ve never know a business to pay more than they have to.

As long as inflation is low, it doesn’t force you to spend money. In fact, saving is still encouraged because you can normally get higher returns than inflation. It just encourages you to not sit on money that isn’t doing anything. Every dollar spent multiplies. When money changes hands a fraction of it is saved, but the rest is spent. The more that’s spent and less saved the more effective dollars there are, as the federal reserve requires a fraction of every dollar saved in a bank to be stored in with the Fed where it can’t be loaned out. This isn’t trickle-down economics. That is a totally different thing.

If you can find where a concensus of experts say deflation actually helps workers, I might believe you. It’s my understanding that they don’t think so.

Wages did in fact grow in proportion to the economy before Nixon.

Are we using the same pool of neoliberal economists who brought us here?

Inflation was still positive before, during, and after Nixon. It’s only been negative a handful of times for very short terms.

I’m not sure what Nixon has to do with anything.

I’m arguing that wages would increase in proportion to the economy, not that inflation would never be negative.

The Nixon Shock brought us inflation as we know it today. He lied that it would be temporary. The Keynesian rationale was adopted after the fact.

This argument is much weaker, but: most Republican economic policy sounds good at a surface level but actually hurts workers in practice. And I don’t think that’s by accident.

“And I’ll prove this by just spouting empty propaganda!”