Why?

- 1 Post

- 90 Comments

48·4 days ago

48·4 days agoYes, many. In most cases a trained doctor has a moral, and maybe contractual, responsibility to help some one, not a legal one. There is no law that says ‘you are trained doctor, you have to help fix this broken leg’. Now if you egregiously refuse the various medical licensing authorities might take a dim view and you might loose your license to practice, but that’s not the same as breaking the law

41·6 days ago

41·6 days agoI think that’s exactly how it’s going to work - you can’t force all ‘fake’ sources to have signatures- it’s too easy to make one without one for malicious reasons. Instead you have to create trusted sources of real images. Much easier and more secure

51·19 days ago

51·19 days agoGood article- thanks

6·23 days ago

6·23 days agoAnd some times people die because of it. What a world

63·23 days ago

63·23 days agoJust not helping

2·23 days ago

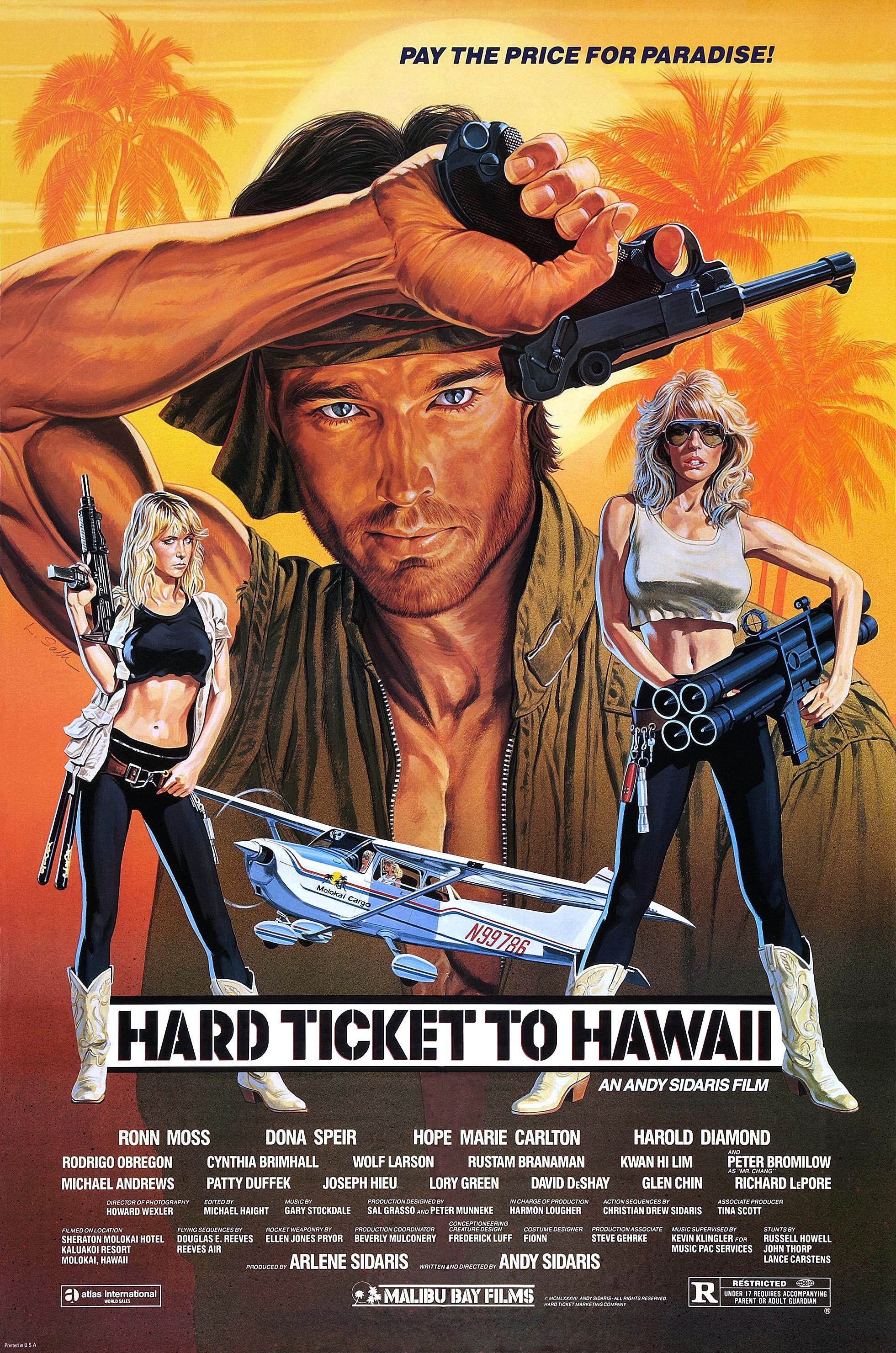

2·23 days agoNow that’s a movie!

2·23 days ago

2·23 days agoTruly awful

A quick review of the lore says no…

46·2 months ago

46·2 months agoGimli was turned into the comic relief dwarf, which was a bit sad

21·2 months ago

21·2 months agoHard though it may be try not to propose solutions unless asked (it’s only taken me 20 years of marriage to mostly learn this!). Every thing else is good though

16·2 months ago

16·2 months agoIf you’re using a webpage JavaScript can see your mouse cursor and anything you type. But only if the browser has focus. So if you’re typing in another window it can’t

35·3 months ago

35·3 months agoNot the same - a bank needs it to be roughly right across a portfolio of loans, I need it to be exactly right for me.

Property tax etc is an understood part of owing a property- an intrinsically valuable thing. I’m strongly in favour of land tax - it encourages the productive use of land. I can’t live in shares, and I can’t eat them. At some point I may make some actual money from them and at that point I should pay tax. I should not be taxed now on possible future gains, anymore than I should be taxed now on a possible pay raise if I get a promotion.

Fairer and more effective tax is essential- and to advocate for it effectively a grasp of the basics is essential. Otherwise you’re counter productive. I feel I’ve made my points and shall withdraw

410·3 months ago

410·3 months agoI’m in favour of tax and rich folk paying more, but a naive imagining that a simple wealth tax is the answer just isn’t helpful. I’m against wealth taxes because they’re crap taxes - they’re easy to avoid, easy to get caught in by accident if you’re not employing an expensive accountant, and therefore a rubbish way of raising money

35·3 months ago

35·3 months agoSomething can be legally liquid, but not practically liquid. Like a house. For example the Board of the company could give me permission to sell, but why would they?

711·3 months ago

711·3 months agoThat’s my point - I’m not making any profit from my ownership of the shares. If I were I’d pay tax on it. All I have a bit of paper which might be worth some real cash in the future. It would become a liability if I had to pay a simple wealth tax on it.

If I use the shares as collateral on a loan and they come good then I have to sell the shares to repay the loan (and pay tax on the sale). If they don’t then I suppose the loan company takes a loss, they’ll have factored that in on to the interest I pay. So probably won’t be so low interest

I completely agree on the economy but and happily pay all the tax I should. But ‘wealth’ is not a simple concept- it comes in many forms, it’s not just a pile of bags of cash with a fat bloke in a top hat sitting on. Even measuring it is hard. So taxing it is really hard and inefficient, which is completely glossed over in these kinds of campaigns

56·3 months ago

56·3 months agoAnd that creates a loophole that is trivially easy to exploit, which is the problem. I simply wrap up any asset I want to hold onto into a fund or trust that stops me doing the above…

31·3 months ago

31·3 months agoAlso require greater transparency around money movement and proper auditing. Governments need to spend more on auditing.

51·3 months ago

51·3 months agoTrickle down is complete BS and the many ways to avoid wealth taxes are part of the problem with them. You need to properly tax income and capital gains and close as many of the loopholes around each as possible. Then add a proper estate tax as well to reduce inter generational wealth

Except, it seems, in Brazil. You learn something new every day