Summary

Since Trump’s second-term inauguration, five top billionaires have lost a combined $209 billion as markets react to policy uncertainty.

-

Elon Musk’s net worth plunged $148 billion as Tesla shares collapsed amid declining European and Chinese sales.

-

Jeff Bezos lost $29 billion as Amazon stock fell 14%.

-

Sergey Brin’s fortune dropped $22 billion following Alphabet’s weak earnings and regulatory pressure.

-

Mark Zuckerberg and Bernard Arnault each lost $5 billion as Meta and LVMH stocks tumbled.

The S&P 500 is down 6.4%, reversing gains seen post-election.

only meaningful if their stocks don’t bounce back, but too soon to tell

Also only meaningful if they can’t buy up actual, tangible assets in the coming recessions, effectively converting their dead capital into more assets. (+ getting more state money for being “too big to fail”)

No, they’re gonna. It’s exactly what happened last recession. The pain got offshored to the workers, and the people with assets used the moment to leverage their assets to buy more assets on the cheap.

Yep, every time the US is in an economic low period, the top 1% snatch up swathes of assets for cheap. It’s how we went from 1 billionaire, to several, then several billionaires to hundreds in the last ~20 years

We just need to keep going until at worlds population billionaires

Do what they do, put some extra cash away and buy an index funds

These companies will absolutely use these things as excuses to replace workers with AI chatbots.

Very similar to what happened just before the “collapse” of the Soviet Union, which seems to be Trump’s aspiration. It had turned into a free-for-all.

Stocks will always bounce back. But the people that live off their 401ks now have to sell at a loss to survive.

I have a theory that this is all planned. Tank share market, buy lots of shares, in a few years they get all their wealth back and more.

So what? It’s not like their bank accounts got affected. Their shares are valued less which means they did not loose money but the lost money they could have had.

They lost pretend money that could be used for business loans that they don’t need because they have so much pretend money. The only time it matteds for these parasites is if it happens when they are acquiring another company worth billions of pretend monies.

Even a stock market collapse is a benefit to these chucklefucks.

The only time it matters for them is when an Italian plumber shows up to collect their debt.

Everything‘s on discount for them now! Time to buy up some cheap stock and failing businesses.

They win no matter what.

Always stood by for, with (fake) money you can make more (fake) money.

The issue is mostly getting towards that money first for us normies who aren’t born into RNG.

Matters at least a bit. For instance, Musk has signalled his interest in buying OpenAI. He will find it far harder to get the money for it now that Tesla shares have nosedived.

More generally with Tesla it is difficult to make a business case for the existence of the company right now, since Musk alienated his entire potential consumer base. I wouldn’t be surprised if the company gets sold into parts in the text two years or so.

sam ALTMAN doesnt seem interested in selling it to him, musk wants to lead in AI research for some reason, since he has nothing show for it. Thiel is the other competitor with"PALINTIR and anduril"

they still have billions stashed somewhere and could buy up things on the cheap/.

They basically use that “money” as collateral for low interest loans. So it impacts how much they can physically buy. It’s a good thing.

Some of them (ahum you know which one) did lose actual value: the entire credibility of their biggest brands are down the drain for years to come… In that way the stockprices do really show that they are losing out. Some others really are losing (sort of) equal access to big important markets… The loss is real, even tho I agree with the sentiment of your post, the lowering stocks predict lowering income, lowering dividends which these people expect to rake in eternally to keep their billionaire lifestyle afloat, etc. They are slowly becoming less wealthy from the shennanigans. Not quick enough tho. A billionaire is a thing that just shouldn’t be allowed to exist ever anywhere.

That’s not enough

The Top 10 Richest Americans have a combined wealth total of $1,548 TRILLION.

$209 billion is only

0.13%13.5% of the of Top 10.We need to get those numbers higher.

Edit: I suck at math, as it was pointed out to me

That doesn’t stack up, Musk is the richest, currently worth $324Bn - they can’t be worth more than $3.24Tn combined.

I think they replaced the period with a comma.

The %s are all out of whack too, it’s more like 13%, which, while not enough, is a lot more than 0.13%.

For sure, Google tells me there’s only 21.2T USD in circulation.

You seem to have forgotten to multiply by 100 after you divided 209 by 1,548.

209 is 13.5% of 1,548, not 0.13%.

Edit: It is a bit disturbing how many people upvote things without making even the most basic sanity check.

🔪🔪🔪🔪🔪🔪🔪🔪🔪

It’s a relatively small price to pay for the power they gained, and most of the losses are elons anyway

We need to keep pumping those numbers up

Coverage like this makes me feel sad.

Do people honestly not realise that billionaires always enrich themselves during recessions?

This is all going to plan for oligarchs. People celebrating it are naive unfortunately.

I would say most of it is meaningless other than Elon and specifically Tesla, Tesla stock prices plumetting will remove most of the power from Elon in the future, even Trump might turn on him once his main thing his net worth evaporates

Yes, the all-but-inevitable Trump decision to throw Musk under the bus is not something I’ve seen a lot of people discuss.

Musk is only a part of the problem, and Musk will have to lose another 110 billion before he even stops being the richest man in the world.

I’d love to see that happen but I’m not holding my breath. Meanwhile it does nothing but enrich powerful Disaster capitalists including Putin and his coterie.

Id be willing to bet that tesla is no bigger than 10% maximum of his worth. His big ones are space X that just chugs our tax money, and starlink, which I believe is being used as navigation in weapons systems being sold to nations. Tesla is effectively meaningless now.

I doubt that

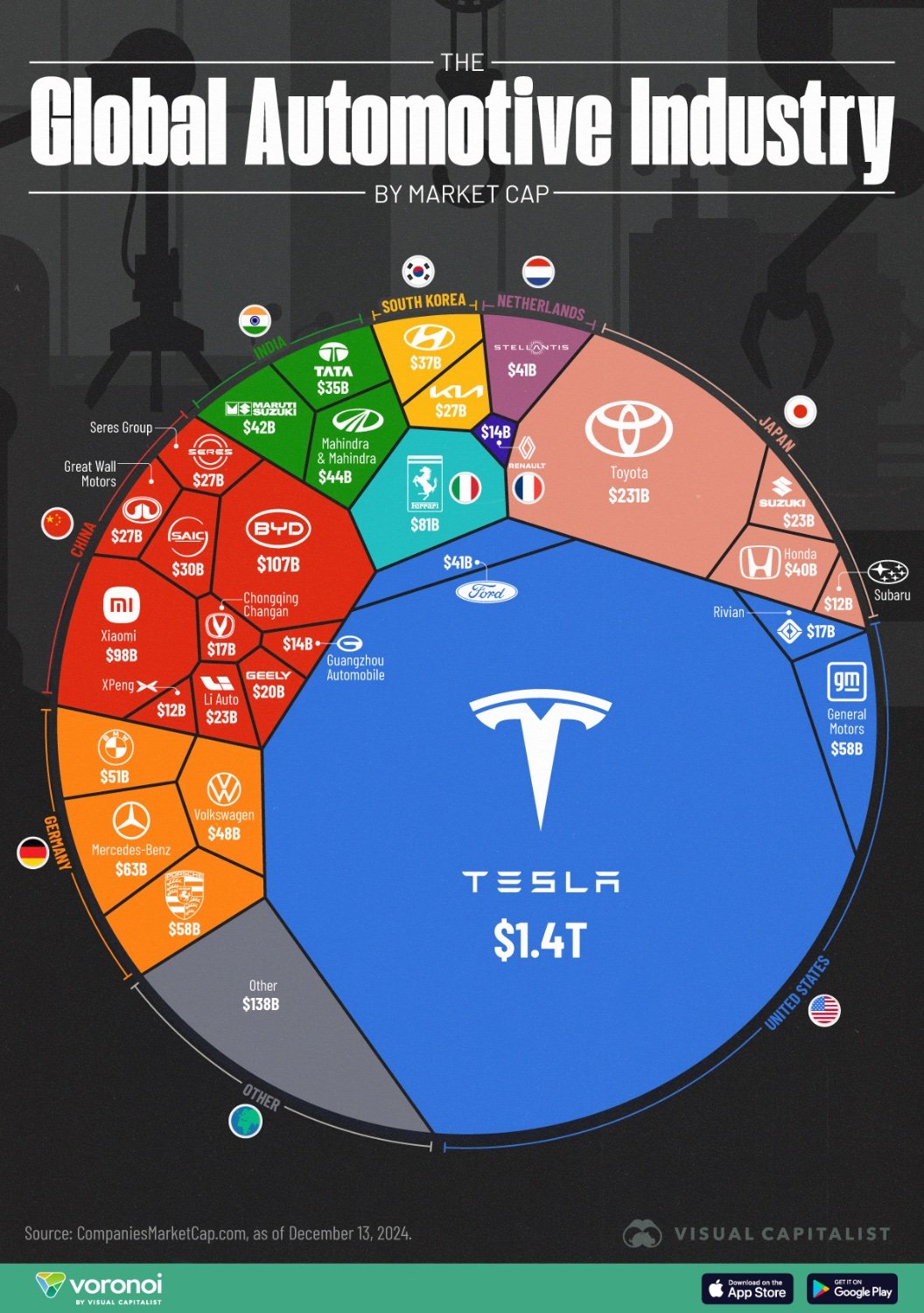

Edit: Tesla’s market cap is now 722 billion, still making it more valuable than any company on this graph. We need to go much lower

This really puts into perspective how massively overvalued tesla is

deleted by creator

It’s a funny argument, because, yeah, a lot of tech companies are overvalued, but that’s not a good thing either

Yeah that’s what a bubble looks like all right

looks more like a cancerous tumor9tesla) crowding out healthy tissue.

That is absolutely wild… I cant believe how much of the industry they are! Well thats great then! I was worried the death of tesla would be unfelt by elon.

He’s hit the level of wealth where he’ll never be poor. But he can be removed from “buy governments” money until such time as he can be held accountable for his actions

Politicians are whores, I really doubt you need more than a billion to own your own starting lineup.

I think you are wrong in the exact opposite direction, spaced just lost a 25 billion contract too

and they have bailouts just in case they cant actually make money.

Daily Reminder:

Those are rookie numbers! We’ve got to pump that number!

Yes, the more they lose the more we win.

PERSONAL AUSTERITY!!! SAVE YOUR MONEY AND LET THE RICH GO FUCK THEMSELVES!!!

You don’t win by them just losing some money. Redistribution is the name of the game. Even if Tesla hits 0/share, you aren’t getting any more wealth just by virtue of that happening.

…Aside from basking in the downfall of a nazi of course, but those are priceless things.

The win is the diminishment of his economical power. Same goes for Amazon and Meta. Transitioning off of any dependence of those websites and services will empower us and remove these shitheads’ influence.

We have to Trump those numbers.

Gotta start somewhere! Keep it going!

Numbers must go down! The Board requires it.

Acting like they have the billions as liquid cash is weird.

IF, and its a big if, they would start selling their assets in order to liquidate their stocks, the assets would nosedive in value to fucking hell. Most of their wealth is smoke and mirrors. Most of them spend money by borrowing cash against their assets.

Tax them so they have to lend or sell some assets to pay their fair share.

It’s pretty common knowledge how these billionaires leverage the value of their stocks/assets as collateral against loans, in order to avoid having to pay capital gains tax.

Even though it’s not liquid cash, there really isn’t much to preclude them from taking out cash loans up to like 70-80% of their value if they ever wanted to (not that they would, as cash depreciates in value due to inflation).

So while you are correct that if they ever had to liquidate their shares the value would plummet significantly - unless something catastrophic happens and the value of those assets plunges well below an acceptable level to their financiers, it will never happen.

If you owe the bank a $100 and can’t pay it back, that’s your problem. If you owe the bank $100m, that’s their problem.

I think we might be nearing a catastrophic economic collapse. It will be interesting to see how these billionaires react.

The whole monetary system is smoke and mirrors. If people don’t consume more than last year the entire system can collapse and central banks buy up all the debt that is suddenly considered bad.

Then we wonder how stores of value like housing, gold, and bitcoin can rise so astronomically in nominal terms.

Capitalism does not “collapse” with 0 or negative GDP growth. I don’t know where people got this idea. You only really see any sort of “collapse” if the social structure breaks down - the basic behaviors of trading continue even in extreme crises, insofar as a society operates with property assigned to individuals like that. Not counting “bubbles” and such as a “collapse”.

We will see the next recession. I’ll bet you that the bailout is bigger than the last, and I’d bet gold continues to rise as QE is unloaded into the market. Its done 10% a year since the Fed started QE every bailout.

What is your prediction for what will become of it, though. GDP growth stops and people start bursting into flames? You know we’ve actually observed this before, right?

Now, if you do mean “capitalism” not in the plain definition of “an economy based around private ownership”, but the more specific version where control of capital is highly centralized - there’s some truth to the idea that economic decline can cause people to start looking to reform that system. True of any system, really, because people generally don’t want to see their quality of life decrease. But that’s very different than an economic system “requiring” it to function.

Not mine , I know exactly how much cash I’ve got …except for the coinstar bucket but that’s for real emergencies

A good start. It takes much more to fix this problem, though.

Them losing billions is meaningless. Don’t for this: if you had 1 billion dollars, and you lost 99% of it, you still have 10 million dollars, which is more than what most people will ever have.

Their entire industries need to be nationalized and ALL their assets seized.

How do you screw both the rich and poor at the same time?

Sheer incompetence. Whenever he says “I’m the only one who can…” I hear “I have no fucking clue how to even begin doing this”.

The rich didnt lost any money, their stock is just lower than in january, but still higher than last year. And it can still get up.

The poor have to cope with higher prices of basic goods, which never comes down.

Only poors are screwed until they eat the leech

It remains to be seen if their kissing the ring was strategic or just tactical (apart from Musk, who is committed), but what they’ve bought wasn’t a good economy. They bought into the transition from democracy and capitalism to authoritarian oligarchy.

Dollars don’t describe the value of Russia-level corruption, which is where the country is now pointed. And the longer-term gains from captured institutions would far outpace a hundred billion dollars or two, if they succeed.

Small but important point. We’ve been an oligarchy for a while now. We’re just losing the pretense of it being a democracy.

Technically we’ve been an oligarchy since day 1. It just didn’t have oligarchy vibes.

Good let’s make it another 200 billion EACH and even then that won’t be enough as they’ll all still have hundreds of billions of dollars which is absolutely insane

Unfortunately our own pensions and such are also getting wiped out by the same forces. And with less access to insider information.

They would become weak enough for us to start curbstomping

They deserve to lose so much more.

Comparing my net worth to that total net worth? I’d be upset, but not terribly so, if I lost $1000 too.

But since I would be getting it back later, and then some, it’s more like a small investment only . Definitely worth the small risk,